University of Luxembourg

Interview with Prof. Lindsay B. Flynn.

Housing is a basic need - but in Luxembourg it has become a luxury. The housing crisis is becoming a trauma for families, a disadvantage for the economy and one of the biggest challenges of all for the new government. Where should government measures start? What are the options, what are the experiences in other countries - and will research be heard? In the "PROPEL" project, an interdisciplinary team from the University of Luxembourg is investigating how citizens are dealing with the situation and what effect politics is having.

Lindsay B. Flynn is an associate professor of political science at the University of Luxembourg since 2021 and Principal Investigator of the PROPEL project. PROPEL (“PROactive Policymaking for Equal Lives,” FNR-ATTRACT grant 14345912) examines the links between policy, housing markets, and inequality by examining the challenges current generations face. Lindsay’s work is published in Politics and Society, Social Politics, and West European Politics, among others. She regularly connects her research with important topics in the policymaking and NGO communities, and recently teamed up with five other organizations to host a full-day event connecting housing research, policy, and practice.

The housing crisis seems to be harder here than in neighbor countries. What is so special about the housing market in Luxembourg?

For a better understanding, let me first explain what affects Luxembourg's housing market in the same way as other countries: since the 1990s, the emphasis of housing policy in Europe has been on home ownership. Tax and housing policies have encouraged people to invest in housing for different reasons. As a sector, housing, and especially housing construction, is an important driver of national economies. At the household level, homeownership can be used to develop equity. In theory, this investment might eventually serve as a replacement or supplement to pensions, or what is called “asset-based welfare” in the scientific research, though in practice this is more complicated. Such enabling polices have become more challenging since the global financial crisis. According to one of my studies, which analyised 11 countries, average homeownership rates declined in seven countries but only increased in four countries - including Luxembourg - among those aged 22-44. Today, becoming an owner is still very much in people’s ethos - home ownership remains a life goal.

Added to this are demographic changes all over Europe that are changing the type of housing needs: Families are getting smaller, the number of single households is increasing. When housing stock does not align with the needs of households at all life stages, it can mean that more households are competing for a relatively smaller number of units.

We are also observing that housing wealth is increasingly concentrated among high-income households. All of these factors are driving the situation and making it difficult to manage the housing market. This particularly hits low-income households and young people.

What is special about Luxembourg is that housing costs are rising faster here than in other countries. For instance, the percentage increase in house prices in Luxembourg is more than double that of the EU average. In addition, housing costs for the economically disadvantaged are higher than elsewhere. Around 40 percent of low-income households here in the country are overburdened by housing costs, which is one of the highest rates in Europe. On the other hand, Luxembourg is also unique because homeownership rates among lower-income households increased - from 30% in 2010 to 40% in 2017 - and this corresponded with an increase in their housing wealth.

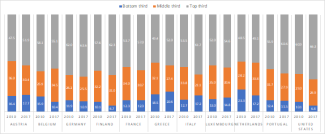

Housing wealth concentration: Percent of gross housing wealth held by homeowners in the bottom, middle, and top third of the income distribution

Readers note: Each bar represents 100% of the housing wealth held by homeowners in a country in 2010 compared to 2017. The colors each represent one-third of the income distribution. If each part of the income distribution held their even share, the bar would be divided into three equal parts, or put another way, 33.3% of the income distribution would hold 33.3% of the wealth. We see this is not the case in any country. The most consistent trend is that wealth is increasingly concentrated in the upper end of the income distribution. In Luxembourg the homeowners in the top third of the income distribution held 52.0% of the country’s housing wealth in 2010 and 54.6% in 2017, similar to other countries. Less similar to other countries, the homeowners in the bottom third of the income distribution held 13.0% of the country’s housing wealth in 2010 and 14.8% in 2017. The amount of housing wealth held by homeowners in the middle-third of the income distribution decreased from 35.0% to 30.6%. Source: Dewilde and Flynn (2021).

Why are prices rising faster here?

As a political scientist, this is not my field of research, but rather that of economists. But the Organization for Economic Co-operation and Development (OECD) has identified various factors: The population is growing faster in Luxembourg than in other European countries, there are more single-person households, and the land available for construction is very limited. All this is increasing the pressure on the housing market. Although there are still reserves of building land, most of it is in private hands. This makes it difficult for politicians to coordinate the right level of housing construction at the right time.

What are the possible consequences of this crisis for our society, from your perspective as a scientist?

The housing market is one of the biggest drivers of inequality. Many countries want to reduce social inequality in line with the UN development goals. However, the market and the policies that have structured this market are creating a wider divide across society.

Those who own housing or housing-related investment(s) in the owner-occupied or rental markets often benefit from increased house prices or increased rents. Those in the rental market do not. When housing costs do increase, especially when they increase faster than wages, it creates greater precarity for the lower end of the income distribution and a greater need for government intervention if one considers housing an enforceable social right. Moreover, Inequality, especially extreme wealth inequality, lures investors into global housing markets. It sometimes leads developers to design and deliver luxury units rather than affordable housing units, since high-income earners and other investors demand such offerings.

In concrete terms, low-income households have to make many compromises and if they don't have enough money, for example, they may decide to delay starting a family, or not to have any more children.

Housing policies and prices also influence voting behavior and welfare state preferences. While the relationship depends on the measure and the country, some research from other scientists indicates that increasing house prices decrease support for redistribution and increase support for more conservative parties. This affects the political arena. It becomes very tricky to push through policy changes in this situation.

What are the guiding questions of your research project PROPEL, which deals with housing policy?

We are trying to understand how housing policies are created, why we have them, what impact they have on people and what inequalities arise. To do this, we analyze existing data, but also conduct surveys, interviews, and focus groups across Europe, including Luxembourg. We include residents, policymakers, NGOs, and the real estate industry in our studies.The main goal is to better understand which policies cause which inequalities.

Can you already share your initial observations?

Many of my initial findings revolve around the younger generations. Historically they have been more “mobile” when it comes to housing. This is because all the common milestones in life, like exiting the parental home, partnering, or becoming a parent often correspond to changing housing needs. My research points to delays in all three that seem to be linked to the difficulty that young people have in acquiring housing.

Of course, there are many other social changes that affect these choices, but housing policy plays a central role. For instance, in one study I find that young people are more likely to exit their parents’ home in countries with higher levels of social housing, easier access to mortgages, low transaction costs to purchase a home, and greater tax relief for ownership.

Are there scientific findings that are not sufficiently taken into account in the public debate, in your opinion?

We could be more aware in the public debate that there are no simple solutions in housing construction. Furthermore, we should not lose sight of the other effects of the crisis in the debate about prices. I am thinking, for example, of the consequences for young parents. Many have to work full-time and commute long distances to work because of housing costs. This is a great burden for mothers in particular, because it is a fact that they still shoulder more childcare responsibilities.

Are are attitudes towards housing changing among the younger generation?

We are probably in a transition period. The younger generation is of course not uniform. Some have easier access to home ownership because they can count on family help. However, young people generally find it particularly difficult to access the housing market. They feel under pressure to become home owners, but realize that it is financially unrealistic and that their parents often had it easier in this respect. Study after study shows that young people are frustrated as a result. Especially when just starting out, they have to decide between living with their parents, living in shared accommodation, and how long they want this kind of lifestyle. It turns out that many young people want more flexible forms of housing, or at least more ease in securing the type of housing that fits their needs.

Since the 1990s, housing has increasingly been seen as a form of investment and less as a place to live or as a right, as is now enshrined in the constitution.

Prof. Lindsay Flynn

Where state regulation can best take effect is the subject of heated discussions. What are the options for policymakers, according to research?

The literature shows that we may be in a post-homeownership society and ownership might play a less important role for younger generations. But we still have strategies from before the financial crisis. One big question for policymakers is at what level to emphasize and regulate each of the three big “markets” – the homeownership market, the private rental market, and the social housing market.

In addition, very targeted measures are commonly needed for vulnerable households that are overburdened, such as refugees, young people and households on low incomes. Rent subsidies and subsidies for buying a home are common across Europe, including in Luxembourg. Some subsidies are better able to target vulnerable households, so it is important to consider who each subsidy benefits and if that is the intended group. One of our current studies examines the rental subsidy in Luxembourg, in a collaboration with the Housing Observatory.

A broader debate on the purpose of housing would be good. It can be spirited, which is a hallmark of democracy. Since the 1990s, housing has increasingly been seen as a form of investment and less as a place to live or as a right, as is now enshrined in the constitution. This "marketization" of housing is not unique to Luxembourg. Social housing has declined almost everywhere. But with a 2 percent share of social housing, Luxembourg is one of the lowest in Europe.

Historically, there have been times when state housing construction was a national priority, for example following the industrial revolution or after the Second World War. Residents and voters must decide whether housing should once again become a national priority now and whether more should be invested in social housing. In politics, we see some evidence that residents may desire this. The “Expropriate Deutsche Wohnen & Co.” referendum in Berlin, for example, aimed to nationalize over ten percent of Berlin’s private rental units.

The research project also talks about tenure neutrality as an option of housing policy. What does this term mean?

It means prioritizing different paths to housing in policy and not just the goal of home ownership. If there are diverse options such as more private rental and social housing, more rooms to rent instead of just entire apartments and other alternative forms of housing, then people have more options and can use different solutions depending on their stage of life. Our neighbor Germany is closer to this neutrality. There are more tenants in Germany, and many people become owners later in life. Policies help determine which form of housing is prioritized.

Do the measures announced by the new government take account of the scientific point of view – is research heard?

The new government's coalition agreement focuses on three pathways: affordable housing, home ownership and the rental market. This generally aligns with my research, which has demonstrated that having more pathways into the housing market helps people secure the housing that best meets their needs and their budget.

If you compare the coalition agreement to the OECD paper I mentioned earlier, you’ll see several areas of overlap. Both emphasize increased social housing, increased densification in urban or suburban areas close to services and public transportation, and incentives to decrease the number of units sitting vacant. That several of the announced measures align with outside research recommendations indicates to me that research is heard.

Author: Britta Schlüter

Editor: Jean-Paul Bertemes (FNR)